Impact Investments That Support Companies Affecting Positive Change

By Ellis Carr, President and CEO of Capital Impact Partners and CDC Small Business Finance (each is part of the Momentus Capital branded family of organizations)

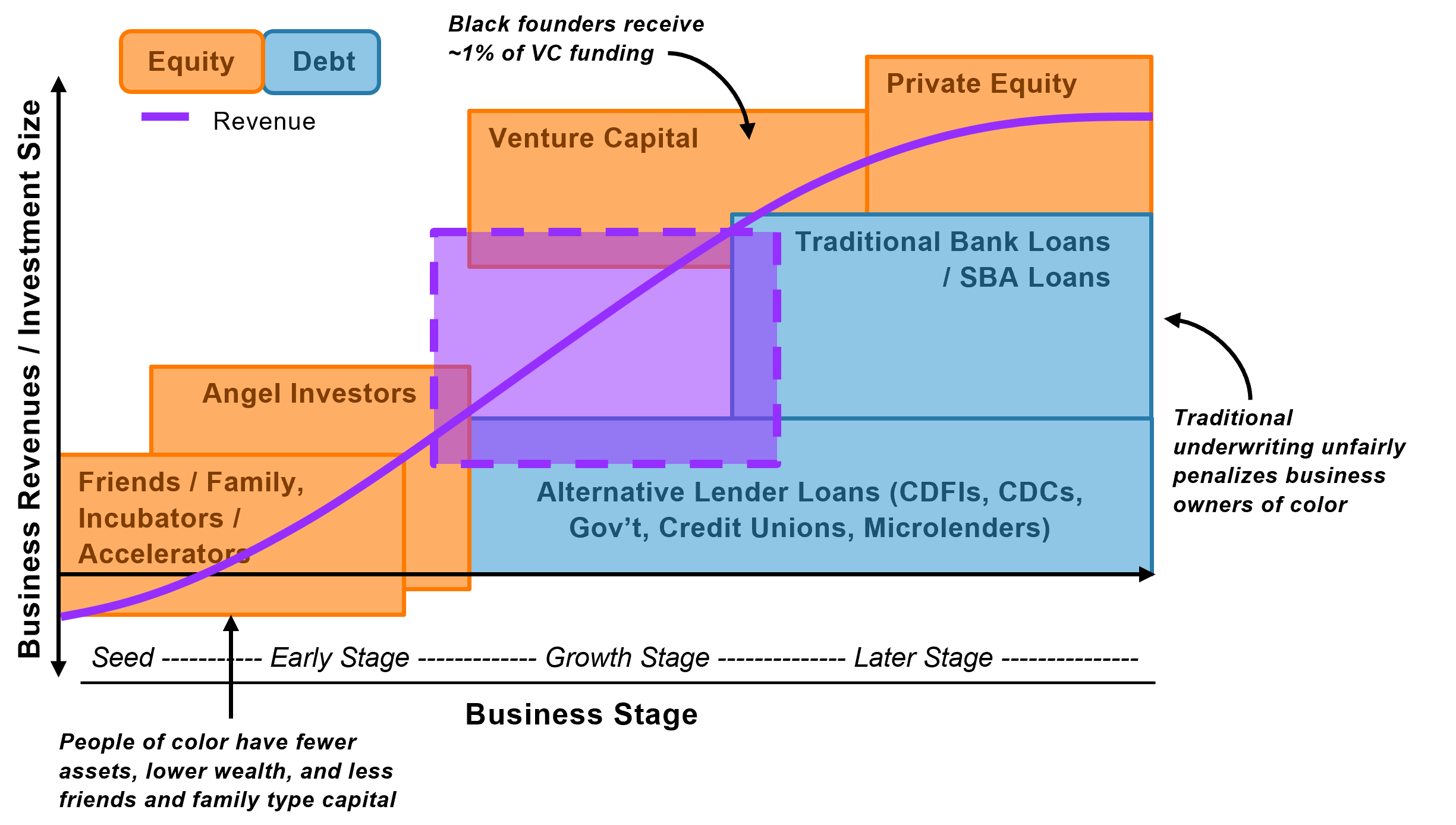

In 2022, a Fast Company piece by Porter Braswell released new statistics that painted a telling picture: in 2021, only 1.4% of Black founders received venture capital funds. That’s a stark number when you consider that more than 13 percent of the U.S. population is Black or African American. It is not surprising, however, given that Black investors only make up 3% of the venture capital industry. The numbers are similarly poor for women-led startups, which only receive 2.3% of venture capital funding, and whose leaders only make up 5.7% of venture capital partners.

When you think that racial inequality, specifically as it relates to Black Americans, has cost our economy over $16 trillion over the last 20 years, it’s clear that our approach to investing in diverse entrepreneurs needs to change.

Companies serving historically disinvested communities, especially those led by entrepreneurs of color, often face barriers to securing the investments that they need to grow. This may include business knowledge that is limited as a result of not having a formal education or not being able to pursue an advanced degree. Limited networks and lack of access to family wealth can create obstacles to securing basic startup costs or working capital. Seeking traditional financing has been an ongoing barrier to success for generations due to systemic biases.

While local leaders are best positioned to drive community-driven solutions, they still consistently butt up against systemic barriers to accessing capital. It is often confusing for business owners to know where to start or who they can turn to. This situation often forces entrepreneurs to rely on extractive capital or on the onerous requirements of debt like putting up collateral or personal guarantees that are often predicated on and exacerbate an inequitable system. Generations of inequality have made it harder for entrepreneurs of color and women to accumulate wealth that could be leveraged for investment. Having less existing wealth means one receives less favorable terms of financing, putting at risk the disproportionately smaller amount of wealth one does have.

The Momentus Capital branded family of organizations aims to interrupt this vicious cycle. We envision an economic system that respects and uplifts all peoples’ right to achieve the dreams they have for themselves, their communities, and generations to come by changing the way community-centric businesses secure capital.

Turning Traditional Venture Capital on its Head

Led by a diverse team of experts, Momentus Capital’s approach is fundamentally different. Starting with a listen-first approach, our focus is on social impact and on growing companies in a culturally respectful manner.

We are uniquely positioned to grow mission-aligned companies by acting as a single source with the ability to provide them with a continuum of financial, knowledge, and social capital.

To us, this takes many forms:

- We provide financial capital through flexible financing options – a range of debt and equity products to meet our partners’ needs, as well as access to new markets and investors.

- We provide knowledge capital through business advising, assistance, and training.

- We provide social capital through connections to networks and people that can help our partners succeed.

In addition to this holistic approach, where we truly differentiate ourselves from traditional venture capitalism is through our philosophy on equity. It is our intention that any impact investment we make is designed to be regenerative or non-dilutive. Our end goal is focused on helping companies grow while also ensuring that the entrepreneurs, employees, and community members retain the equity.

Investments That Support Community-Focused Companies

Our impact investments team also takes a unique approach that begins by getting to know the company from the inside. This helps us understand what impact the company wants to have on its community; what unique solutions it is seeking to deliver that support equitable outcomes for health and wealth building; and what challenges the company has faced in raising capital as a result of being led by an entrepreneur of color or of serving a disinvested community.

Armed with that knowledge we can develop a flexible and patient approach that is first and foremost designed to help businesses achieve their growth visions sustainably.

We do this by offering these primary investment vehicles:

- non-dilutive preferred equity whereby cash flow positive businesses pay a fixed payment and dividend

- revenue/profit-sharing structures that are structured to help companies manage volatility

Our Sector and Geographic Focus

We put these tools to work by engaging with diverse entrepreneurs focused on building healthy, inclusive, and equitable communities. This includes companies that:

- Create economic opportunities to support intergenerational wealth-building

- Improve access to affordable, healthy food

- Improve access to healthcare and insurance

- Grow employee-ownership structures such as cooperatives

We’re further helping to fuel economic growth and opportunity by fostering deep connections in our communities. Currently, the Momentus Capital impact investments program target geographies include Atlanta, Ga.; California; Detroit, Michigan; the Washington, D.C. metropolitan region; Miami, Florida; New York Tri-State area; and the Texas Triangle (Austin, Dallas, and Houston).

Demonstrated Success

We’ve already demonstrated the positive impact that our approach is creating with and for community-minded companies.

Take, for example, Abner Mason the president and CEO of SameSky Health. Mason launched SameSky in 2013 to advance health equity for Americans who are marginalized or under-resourced by helping them better navigate the complex health care system.

To grow his company, Mason needed investors but has long been frustrated by those who either would not invest in him as a Black CEO, or were not supportive of his solutions that focused on disinvested communities.

Where others saw risk, we saw an opportunity. Through our impact investing program, we provided SameSky Health with a $5 million venture debt bridge loan to support the growth of the company as they progress to raise Series C funding.

You can read more about our partnership with SameSky in this Q&A with Mason.

We also worked with Obran Health, a unique company that operates worker-owned health care companies designed to give decision-making processes and capital back to caregivers, operators, and health care workers. A lot of Orban’s affiliates are managed by worker-owners who are women of color, and so this was an excellent opportunity to make an investment that supported wealth building in a way that would stay with the employees in their communities.

You can read more about our partnership with Obran Cooperative in this story.

When Obran Health sought to acquire Physicians Choice Home Health, a home health care provider in Los Angeles, we provided a $1 million preferred equity investment. This allowed Obran to avoid the traditional route of syndicated loans and debt which would have hampered their long-term growth.

Impact Investing for Health Equity: Q&A With SameSky Health CEO Abner Mason

Abner Mason came up with the idea for SameSky Health in 2013 with a dream of creating a company that is on a mission to advance health equity. From its inception, SameSky Health has been focused on engaging and helping Americans who are marginalized or under-resourced.

To advance that mission, Mr. Mason worked with Momentus Capital, a family of mission-driven organizations that includes Capital Impact Partners, CDC Small Business Finance, and Momentus Securities. Through our impact investing program, SameSky Health received a $5 million venture debt bridge loan to support the growth of the company. We talked to Abner about how this investment is helping SameSky Health in its efforts to address a significant market challenge to help disinvested communities get guidance and navigate a complex health care system.

Q: What do you feel you have achieved the most since starting the company?

Abner: I’m very passionate about the mission of SameSky Health, to create cultural connections for a healthier, more equitable world. I feel fortunate to have built a company where people who are just as passionate as I am about our mission have joined the organization. We’ve built a team of incredibly talented people who are focused on creating a solution that enables equitable health care.

Health equity is at the center of everything SameSky Health does. We have established ourselves as a leading health equity company. We are focused on raising the bar in America for health equity and how we should treat the people we are trying to help navigate our complex health care system.

We have built a leading, scalable health equity technology platform, unlike no other, that enables health plans and other health care stakeholders to comply with new health equity-related requirements that they will have to comply with now and in the future.

Q: The need for funding means that you’ve achieved a certain amount of growth. What challenges/barriers have you faced in terms of attaining funding for SameSky Health?

Abner: One of the major challenges I have run into over the course of my career is trying to raise money as a founder of color. I am optimistic about the future, as I have seen great progress being made from investors in startups supporting new businesses founded by people of color, which has more than doubled since 2020.

Another challenge I have faced in the past is gaining support from investors to raise funds for a solution that addresses low-income, underserved communities, particularly those people who are enrolled in Medicaid. Up until recently, venture capitalists did not understand the Medicaid market or the extraordinary need for advancing health equity. I am very optimistic about the traction in investment and innovation in this space over the past two years to help address health disparities.

Q: Momentus Capital, however, is able to offer something that hopefully can make an impact with a lower risk. Any thoughts on that relationship so far?

Momentus Capital is essential for a company like SameSky Health. The company played a crucial role in helping SameSky Health secure bridge funding as we progress to raise our Series C funding, which is the next step. We are deeply grateful for their flexibility and support of SameSky Health.

Q: Why did you choose Momentus Capital versus another investor? What was the difference maker for you?

Abner: It was clear to us that Momentus Capital values working with partners to impact change in the health care system and drive health equity. This aligns well with our values and mission. Their approach allowed us to easily structure a deal that was fair to everyone given our alignment around advancing health equity. Momentus Capital stands out from others for their flexibility in working with our team and their ability to quickly move toward a transaction to help us continue scaling and driving equity in health care.

Q: How do you think SameSky Health improves the lives of people in the community through health care, and how does proper investment into funding drive these positive aspects?

Abner: SameSky Health has built an innovative solution that combines technology and human touch to deliver a culturally tailored, personalized experience to members of health plans. If the health care industry continues to try to address challenges the same way they always have, we’ll never achieve better outcomes. Innovation and investment in health care IT innovations are so important. Investors need to support startups that are building solutions that will meet the needs of low-income, underserved communities. Investors need to be more proactive in seeking opportunities to work with companies such as SameSky Health.

Now You Can Invest In Underserved Communities with Capital Impact

By Ellis Carr, President and CEO

The idea of “community” often conjures images of a geographic place, a shared space where people congregate. While true, communities can be so much more. Their true potential can manifest itself when they foster connections between individuals who share mutually beneficial ideals. Through championing those shared values, community members can create a future of shared prosperity.

How CDFIs Expand Economic Opportunities in Underserved Communities

More than Money Podcast Interviews Ellis Carr, President & CEO of Capital Impact

Expanding opportunities for residents in low-income communities is the focus of community development financial institutions (CDFIs). These mission-driven institutions prioritize social, economic and racial justice for underserved communities over and above profits, meaning that CDFIs invest in places and projects that traditional lenders are often reluctant to support.