October 1, 2024 (Arlington, VA) – Capital Impact Partners has been awarded a $50 million New Markets Tax Credit (NMTC) allocation (PDF) from the U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund). These tax credits incentivize private sector investors to partner in community financing efforts.

“This award will help us bring private investors and key partners together to increase access to critical social services in disinvested communities, including health care, education, and healthy foods,” said Mindy Christensen, senior vice president of Community Development Lending for Capital Impact Partners, which is part of the Momentus Capital branded family of organizations. “We plan to focus this funding on projects in major metro areas in the states of California and Texas, and in the cities of Atlanta; Detroit; New York City; and Washington, D.C.”

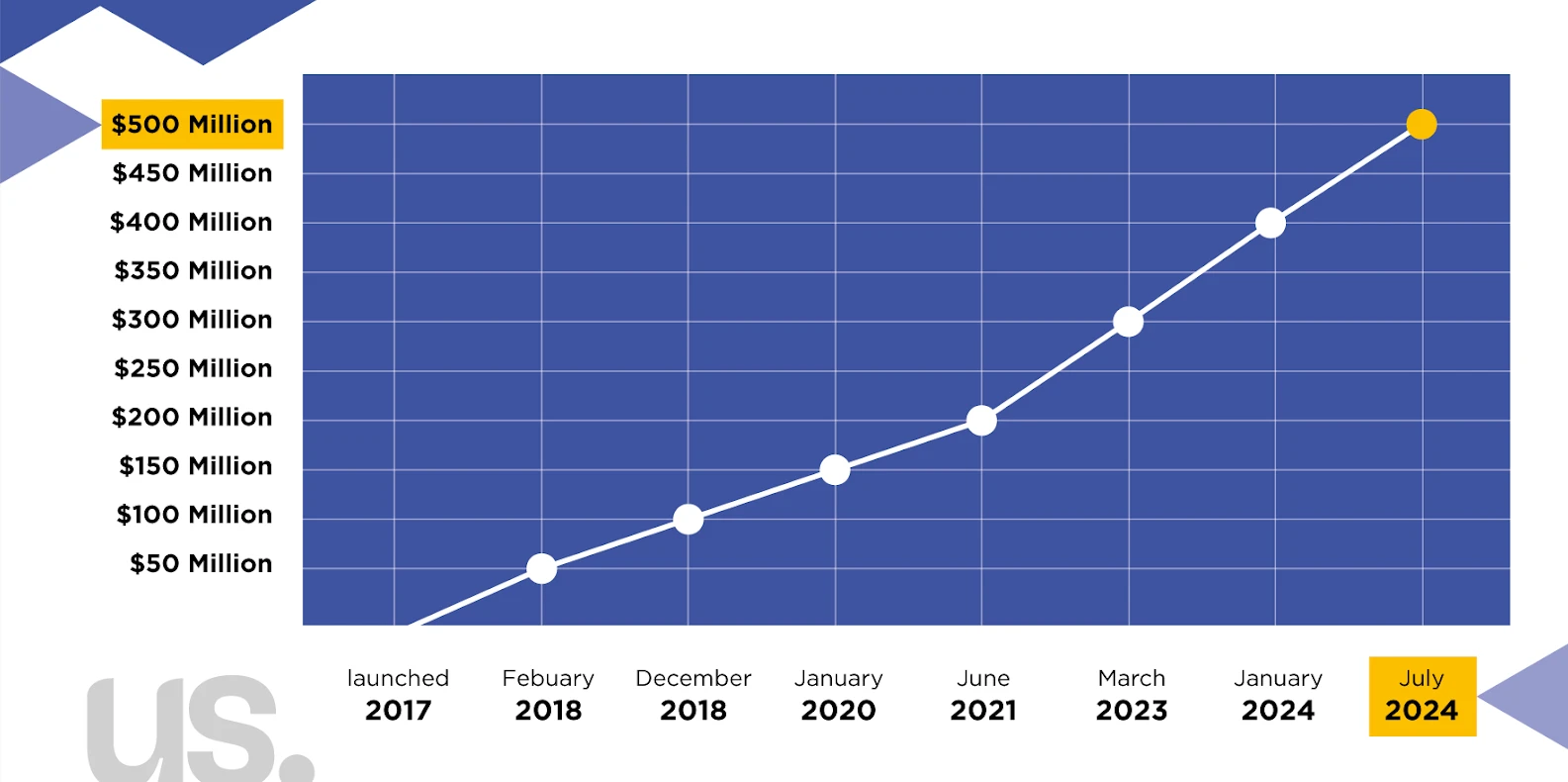

Capital Impact Partners is now an 12-time NMTC recipient – with awards totaling $792 million. To date, the organization has used NMTC allocations to support the financing of 94 transactions nationally.

Capital Impact Partners’ NMTC investment strategy prioritizes healthcare, education, and multi-service community organizations in the states of California and Texas, and in the cities of Atlanta; Detroit; New York City; and Washington, D.C:

- Healthcare: Projects that address the lack of affordable health care in communities living with low incomes

- Education: Projects that address the lack of quality, affordable education in communities living with low incomes

- Multi-service community organizations: Projects that address the high levels of food insecurity in communities living with low incomes

This year’s announcement brings the total amount awarded by the CDFI Fund through the NMTC Program to more than $81 billion. Historically, NMTC Program awards have generated $8 of private investment for every $1 invested by the federal government. Through the end of fiscal year 2023, NMTC Program award recipients deployed almost $63.6 billion in investments for communities and businesses earning low incomes, with impacts such as the creation or retention of more than 894,000 jobs and the construction or rehabilitation of nearly 259.5 million square feet of commercial real estate.

“Today, we announce the 20th round of New Markets Tax Credit allocations, which has attracted billions in private capital into businesses and projects in communities living with low incomes nationwide as they continue to recover from the impacts of the pandemic,” said CDFI Fund Director Pravina Raghavan. “These investments have spurred job creation, the rehabilitation of commercial corridors, and the development of community facilities like health clinics, charter schools, and food banks, all examples of how New Markets Tax Credit investments are vitally important for low-income urban, rural, and Tribal communities across the country.”

Creating High Impact Projects through NMTCs

Capital Impact Partners has deployed a variety of NMTC allocations to help launch projects nationwide. Examples of those high impact projects include:

Native American Health Center, California

With one of the largest national intertribal American Indian urban populations, the Native American Bay Area community first opened the Native American Health Center (NAHC) to meet the healthcare needs of an increasingly underserved population. Since 1972, the NAHC has become one of the oldest and largest Urban Indian Health Programs in the country. Today, the NAHC serves over 14,000 people every year through a network of clinics in the Bay Area, providing services such as primary medical care, comprehensive dental care, and community wellness services.

The NAHC identified Oakland’s Fruitvale district — where 30% of neighborhood residents live in poverty, 84% of local families with children receive food assistance, and only 29% of the total population receives Health Center Program coverage — as an underserved community to provide its services to.

Along with Bay Area community leaders, the NAHC began plans for construction of a new Fruitvale location. Capital Impact Partners, in partnership with Community Hospitality Healthcare Services, LLC, provided $21.5 million in NMTC allocation to support the construction of a 14,000-square-foot health and cultural facility. Broadstreet Impact Services, through its Propel Fund, served as the NMTC investor.

In collaboration with Satellite Affordable Housing Associates, the NAHC will utilize NMTC and Low Income Housing Tax Credit financing to build a five-story, mixed-use development with a health center, cultural center, and 76 affordable residential units. The NMTC financing will allow the NAHC to operate 20 dental operatories, dedicated space for social services, and a large 300-person capacity cultural community center.

The NAHC expects the health center to serve 10,000 individuals per year, provide 20,000 additional annual visits, and create or retain 47 long-term jobs for the Bay Area community. The NAHC broke ground for the project in March 2024 and is expected to open the facility for services in late 2025.

Coastal Bend Food Bank, Texas

Coastal Bend Food Bank (CBFB) is a nonprofit organization in Texas that solicits and distributes food which might otherwise go to waste or be discarded by manufacturers, wholesalers, and retailers. Since 1982, CBFB has been fighting hunger in the Coastal Bend by providing food and personal care products to various charity and service agencies. It is serving 13.7 million pounds of food annually to more than 50,000 individuals in 11 counties throughout South Texas.

The construction of a new 108,200-square-foot warehouse and distribution center in Corpus Christi will enable CBFB to distribute more than 19 million pounds of food by 2028, a 43% increase over 2020.

The building opened in 2024 and aims to ease a community crisis where explosive growth for the food bank has led to urgent facility needs. As a smaller metro area, philanthropic dollars are limited, so NMTC is a critical means of supporting this expansion.

Capital Impact Partners joined with Raza Development Fund, Texas Mezzanine Fund, and US Bank on this $29.25 million NMTC project.

San Ysidro Health Center, California

San Ysidro Health (SYH), Inc. is the second largest health center network in the San Diego area and provides a range of services including medical, dental, pediatrics, women’s health, urgent care, and behavioral health across its more than 40 locations. SYH primarily serves racial and/or ethnic groups (92% of FY20 total patients), patients living with low incomes (95% of 2020 patients at or below 200% FPL), and uninsured patients (20% of 2020 patients). In 2020, SYH had 96,000 unique patients and almost half a million visits.

The ground-up construction of a 44,000-square-foot health clinic and PACE (Program of All-Inclusive Care for the Elderly) center in National City, California, is part of a larger master plan that also includes affordable housing. The new National City clinic will add up to 78,338 visits per year; additionally, the new PACE center will be able to serve 600 older adults. It is expected to open in summer 2025.

Capital Impact Partners joined with National Cooperative Bank, Center Capital Fund (Capital Fund, a part of Capital Link), U.S. Bank, Corporation for Supportive Housing, and Border Communities Capital on this $58 million NMTC project.

How Do New Markets Tax Credits Work?

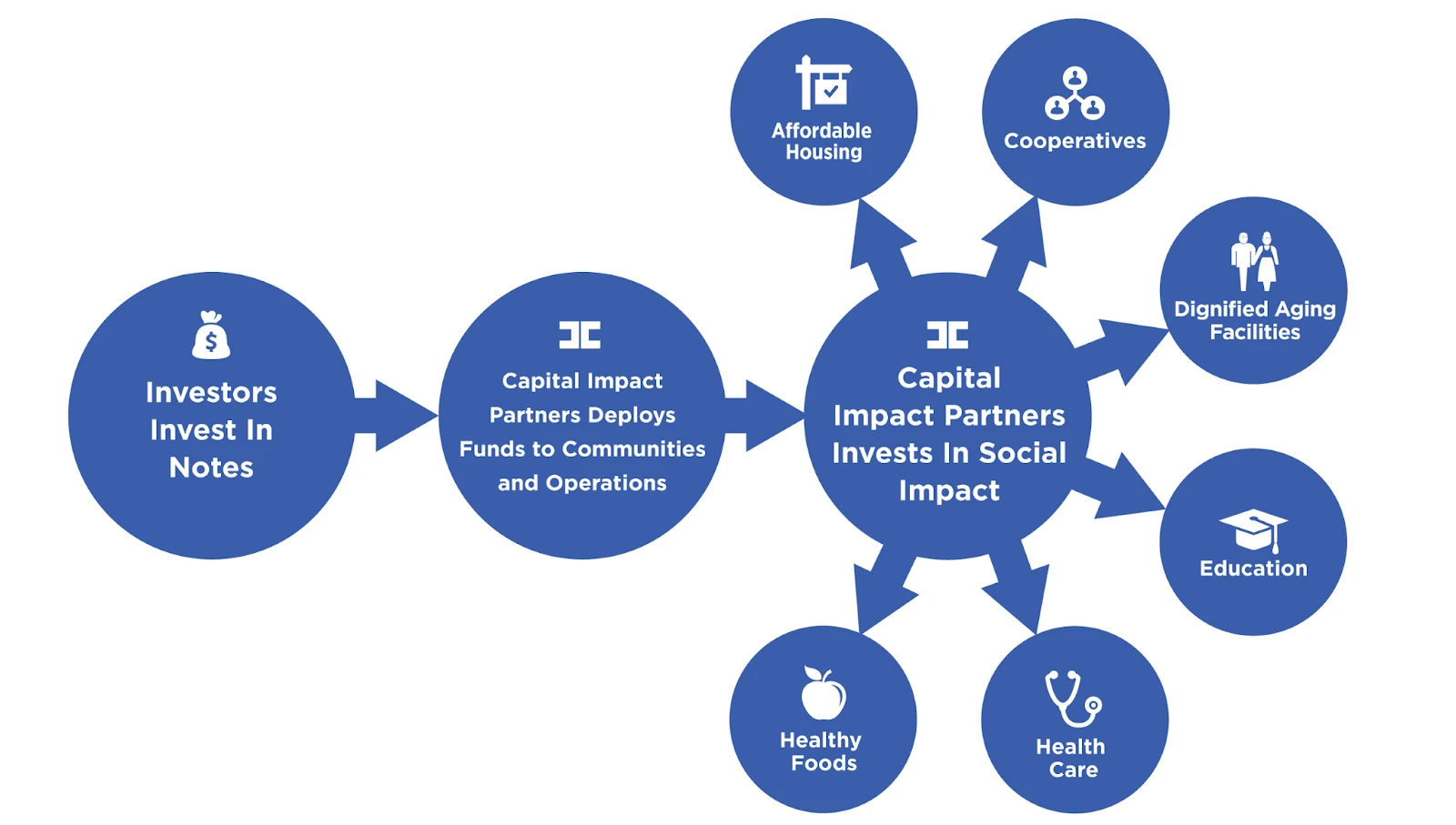

Managed by the CDFI Fund, NMTC allocations make their way into the community through the following process:

- A community development entity (CDE) submits an application to the CDFI Fund requesting the authority to allocate a specific dollar amount of tax credits.

- If its application is approved, the CDE is awarded the authority to allocate tax credits to an investor.

- The investor chosen by the CDE receives a tax credit totaling 39% of the cost of the investment. The investor can claim that tax credit over a period of seven years.

- In exchange for those tax credits, the investor makes a qualified equity investment (QEI) in the CDE.

- The CDE must use the QEIs it receives from the investor to finance businesses or real estate projects in communities living with low incomes, where the poverty rate is 20% or higher or the median income is 80% or lower than the Area Median Income. The CDE also has the option of investing in other CDEs making loans in areas with residents earning low incomes.