Community Development Financial Institutions (CDFIs) were born out of the civil rights movement to ensure that nonprofits and businesses — particularly those in underestimated communities and communities living with lower incomes — have equitable access to loans. Yet, CDFIs are part of a financial system embedded with discriminatory lending practices which need to collectively be addressed in order to fully achieve the intended goal of equalizing access to financial resources for all people.

Momentus Capital’s family of organizations, including Capital Impact Partners, CDC Small Business Finance, and Momentus Securities, is working to help support economic mobility and wealth creation through more equitable access to capital for communities that have been long overlooked by traditional financial organizations.

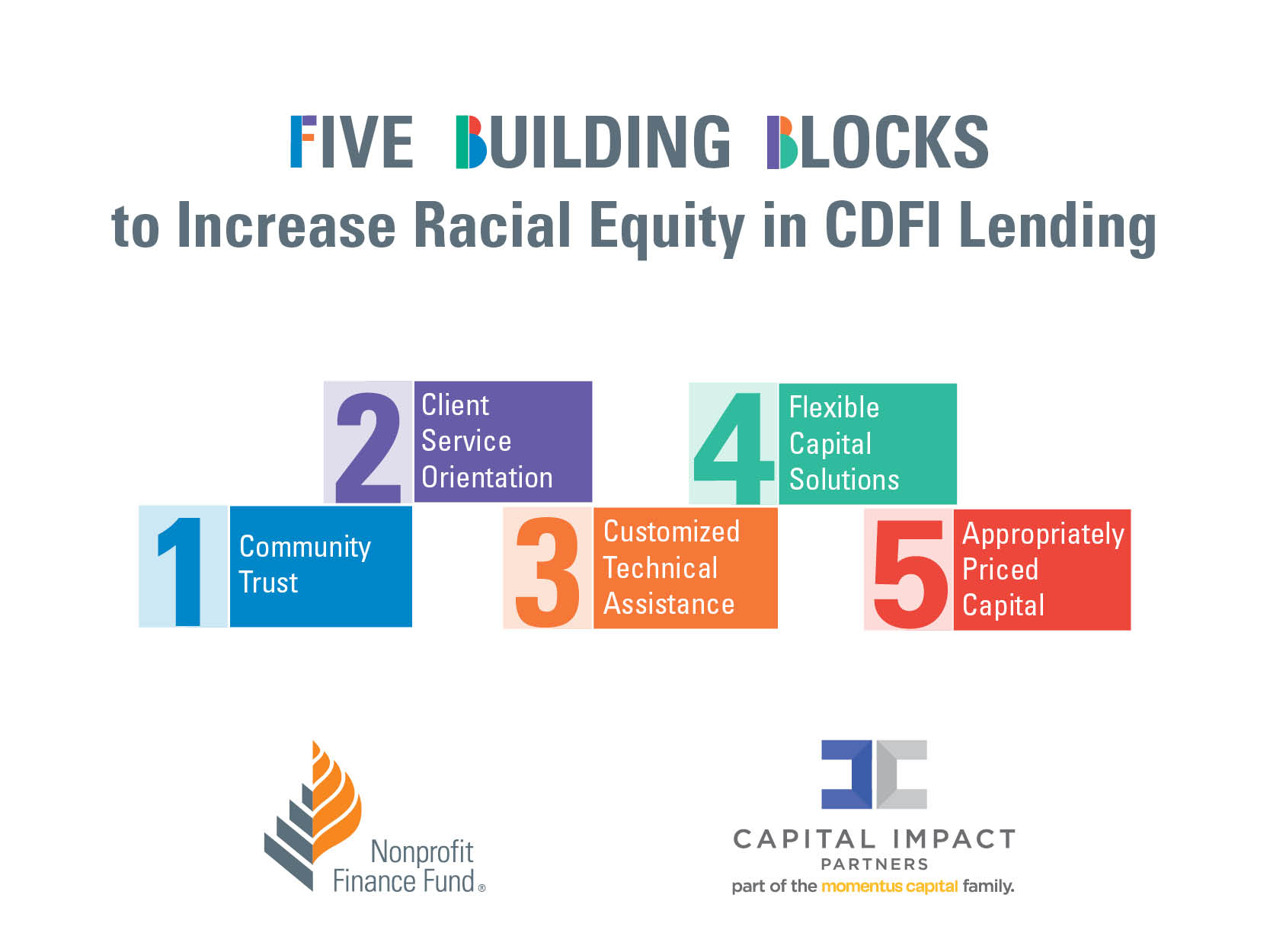

In line with this commitment, and in recognition of discriminatory lending practices identified within CDFIs, Capital Impact Partners collaborated with Nonprofit Finance Fund (NFF) to identify and address policies and practices that contribute to it. We conducted research to understand how some local and national CDFIs have successfully taken steps to address inequity within their own lending practices.

Learn more about the partnership and read the full report on momentuscap.org.