Scott Sporte, Chief Lending Officer

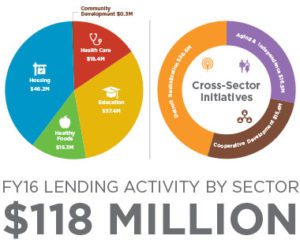

We have had a strong year in our len

Across the country, our borrowers created 2,500 high quality jobs with benefits, hundreds of new housing units and together served more than 40,000 people nationwide. Ellis Carr, Capital Impact’s CEO, highlighted some of their stories in his retrospective.

In Detroit, our lending knits together with a place-based inclusive growth revitalization strategy backed by quantitative research and policy advocacy. Our newest housing report analyzed the effects of concentrated poverty on the city and how to address the potential for displacement that could come from new development.

Our new report outlines was to avoid relocation and displacement of residents in revitalized cities.

Using that research, we worked with local partners and national funders to develop the Stay Midtown program, which helps low-income residents remain in their neighborhoods as rents rise. This small pilot will be assessed, improved and replicated in other parts of Detroit and around the country. A $4.8 million grant from the Capital Magnet Fund will help us substantially increase the number of affordable units in Detroit. Using that grant as a base, we will leverage more than $50 million in new financing for 550 units of affordable housing.

Over the next few years, we will increase our commitment to Detroit, expanding into neighborhoods of opportunity beyond the urban core, helping to create mixed-use, mixed-income communities that provide housing, employment and services to all Detroit residents. One of the leading voices and most passionate supporters of this multi-year vision for Detroit was Bradford Frost, our colleague and friend, who passed away in January 2017. We hope our work will honor and help realize Brad’s vision for the city he loved.

Outside of Detroit, we kicked off our Healthier California Fund in partnership with The California Endowment and the State of California COIN tax credit program. This $25 million fund uses grants and low-cost financing to support innovation and growth at California community clinics and health centers, helping them build capacity to deliver high quality, culturally competent health care regardless of their patients’ ability to pay.

With financing from our Healthier California Fund, the Tri-City Health Center is creating access to quality care in Fremont, California.

An early example of a health center benefiting from the program is Tri-City Health Center in Fremont. This health center used financing to serve 8,000 more patients annually, most of who live at or below the Federal Poverty Line. This health center’s work supports our broader health care vision that I wrote about in Capital Weekly. As the Healthier California Fund’s work spreads to other parts of the state, we will see expanded access to excellent primary care for thousands more in California.

Rural older Pennsylvania residents will have new health care options thanks in part to our Age Strong Fund.

Our financing and technical assistance also benefited seniors in rural western Pennsylvania, leveraging support from the AARP Foundation to finance the Primary Health Center in Transfer, an area of fewer than 6,000 people. The majority of this health center’s patients are over 55 and, without this health center, would have to drive more than 30 miles to receive care. In Clovis, a small town in California’s Central Valley, financing and technical assistance are helping construct a new affordable assisted living facility so that Clovis’ seniors may age in their community.

We are grateful for support from the CDFI Fund that has helped us develop products and expand our work into areas where traditional investors are not active. Grants for Financial Assistance and the Healthy Food Financing Initiative will help us increase access to primary care, create jobs in the food economy, and expand our coverage to areas underserved by other lenders. Every dollar we have received in grants will leverage another $10–or more–from other sources as the critical CDFI Fund grants help reduce risk and catalyze development. Awards from the New Markets Tax Credit program and the Bond Guarantee Program help us finance large facilities whose credit profiles, with higher loan to value ratios and tighter debt service coverage, could not be financed through traditional sources.

We are stepping into a new mission and vision that has us doubling down on our impact in communities. As a mission-driven lender, we use the tools of financing, technical assistance, advocacy and research to effect change, provide meaningful choices and create access to economic opportunity in places where they did not previously exist. Others have seen risk in these rural and urban areas around the country and have avoided them; we have instead seen mission-driven opportunity, and we’ve been able to create lasting change while managing risk.

Our confidence in this approach is bolstered by our strong balance sheet as noted by our Chief Financial Officer Natalie Gunn. We’re proud the value we deliver has been recognized by our AA rating from S&P.

The road ahead is a long one, but we are determined to bring every tool at our disposal to bear. This past year saw many successes that leave us optimistic for the future.