By Scott Berman, Director, Policy and Development

The civil rights movement sought to end legalized racial discrimination against Black-American individuals and communities. For generations, Black Americans were systematically denied opportunities that their White counterparts experienced, from the ability to buy homes to accessing quality education to equal treatment by the criminal justice system.

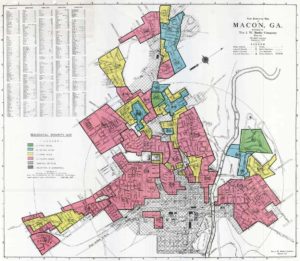

Redlining was a common practice, keeping communities of color out of “desirable” parts of town. The effects of this practice continue today.

For example, many communities – often communities of color and communities facing economic hardship – did not (and many still do not) have access to equitable financial services. Through redlining and disinvestment associated with years of lending discrimination, communities with lower incomes were unjustly deprived of access to credit and beneficial banking services. In addition, with few-to-no physical banks in their communities, individuals and families were often left with options that provide purely predatory services, such as payday loans.

What is the Community Reinvestment Act (CRA)?

The Community Reinvestment Act (CRA) was created in 1977 out of the civil rights movement to address historical disinvestment in communities across the country by encouraging financial institutions to better meet the credit needs of the communities in which they do business, including those considered low- and moderate-income and communities of color. Compliance with CRA is taken into consideration by federal regulatory agencies when considering approval of new bank branches or mergers and acquisitions. It was one of several landmark pieces of legislation enacted in the wake of the civil rights movement to address inequities in bank lending.

While CRA regulations have long needed improvement, the progress that has been achieved is at great risk due to the first major changes to CRA since 1995. Through a recently published Notice of Proposed Rulemaking, the Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC) – two of the regulatory agencies charged with enforcing CRA – are seeking to undermine its fundamental purpose.

The proposed rule changes create significant loopholes that would allow private banks to meet their CRA requirements without actually expanding economic opportunity for historically disinvested communities. The proposed “non-exhaustive list” of eligible activities now includes investments in infrastructure, transportation, Opportunity Zone investments, and even sports stadiums.

How Proposed CRA Changes Create New Barriers to Economic Justice

According to the proposed regulations, a bank’s adherence to CRA would be primarily based on a new evaluation framework, which has become known as the “one-ratio” measure. Regulators would examine a bank’s dollar value of eligible activities compared to their retail deposits, instead of actual impact benefiting underserved communities.

Economic investment in communities that have experienced historical disinvestment can break barriers to success and transform outcomes for individuals and families.

So while banks would appear to do more in the coming years in the dollar volume of CRA activities, those activities would actually be less impactful, less targeted to individuals with low-to-moderate incomes and underserved communities, and with fewer community partnerships that respond to local needs.

In addition, the expanded list of CRA-eligible activities would include some of what banks already do in the ordinary course of business, thereby further diluting the effectiveness of CRA. Some additional concerning changes include the following:

- Financial education could now benefit people of all income levels instead of just people with low-to-moderate incomes.

- The definition of affordable housing would be relaxed to include middle-income housing in high-cost areas.

- The revenue size for defining a small business would be raised from $1 million to $2million.

It should be noted that the Federal Reserve, which usually works in tandem with the FDIC and OCC on CRA regulations, has decided to issue its own proposal.

CRA Changes and Implications for Community Development Financial Institutions

Health care, affordable housing, education, and healthy food are critical social services that CDFIs are able to provide through the Commuinty Reinvestment Act.

Like CRA, Community Development Financial Institutions (CDFIs) emerged from the civil rights movement and continue to mirror the spirit of the civil rights movement. CDFIs work to ensure that disinvested communities have access to critical social services and opportunities that support wealth building and shared prosperity. As a CDFI, Capital Impact Partners’ mission is to break down the barriers that communities experiencing historical disinvestment find between themselves and their goals. We see how systemic racism and disenfranchisement hold the communities that we serve back from achieving the same outcomes as those that have not experienced disinvestment. We work every day to live up to the principles of the civil rights movement and build power within communities so that all Americans can fulfill the dreams they have from themselves and future generations. The high-impact projects we finance, from community health centers to affordable housing to new education facilities, are exactly the types of investments that CRA was designed to support.

To continue the spirit of the civil rights movement that CDFIs were created to uphold, targeted investment in disinvested communities by financial institutions must be fostered.

The proposed CRA changes from OCC and FDIC would drastically reduce the effectiveness of CDFIs to invest in their communities, particularly of smaller CDFIs. Between 2005 and 2018, the amount of lending from banks to CDFIs increased from $1 billion to $4 billion. Weaker CRA regulations would hamper the CDFI-bank borrowing relationship, resulting in CDFIs having less critically needed capital to put toward community development projects.

Every day, we see the need for equity as a central element of the work that we do alongside our neighbors and partners. Since the founding principle of CRA was to create economic opportunity for disinvested communities, the proposed “modernizations” should be scrapped in favor of strategies in the true spirit of the civil rights movement and origins of CRA.

We encourage each of you to visit the websites of these regulatory bodies and provide your own comments as well.