This blog also appears on the Engage R + D blog. You can find it here.

How can foundation dollars be more powerful in a time of crisis? As COVID-19 continues to disproportionately impact communities that have long experienced economic disinvestment, many are asking how to leverage philanthropic funding differently for more immediate impact and greater social good. One solution comes in the form of impact investing, which includes a range of financial tools for both individuals and institutions seeking to do greater good with their dollars. While impact investing is not new, it is a powerful tool that many foundations seek to better understand and that remains relatively underused in philanthropy. [1],[2]

|

Grants vs. PRIs: What’s the Difference? Grants are most foundations’ bread and butter. They support a foundation’s charitable mission and are limited to 501(c)3 tax-exempt organizations. Grants do not require repayment. PRIs are an IRS designation that allow private foundations to make charitable, mission-aligned investments. These investments typically take the form of low-cost financing and loans, which require repayment within a specified time. While many require a return or accrue interest, they are not expected to produce market-rate returns. |

The California Endowment—a California foundation dedicated to expanding access to affordable, quality health care since 1996—is at the forefront of leveraging its investments to strengthen and innovate beyond the existing system’s status quo. In addition to its significant grantmaking to organizations across the state, the foundation has allocated $200 million to program-related investments (PRIs)[3] focused on furthering the foundation’s health and racial equity mission. The umbrella of investments supports greater access to housing and healthy food systems, as well as nearly $40 million in investments committed to expanding and supporting community health centers across the state of California since the program’s inception.

Since 2017, Engage R+D has partnered with The California Endowment to evaluate its grantsin expanding access to quality health care through the Affordable Care Act and Prevention efforts. Most recently, we focused on learning more about how The Endowment and its investment partner, Capital Impact Partners—a Community Development Financial Institution (CDFI) with expertise in health center loans—are using PRIs through their Healthier California Fund to support clinic financing and innovation within federally qualified health centers (FQHC) and non-FQHC health centers in California. These investments, which would not be possible as traditional foundation grants, are impacting California health centers and communities in two significant ways.

1. Opening new avenues for clinics to access credit

Recent work on impact investing highlights how foundation PRIs often help fill a gap when a “nonprofit or social enterprise needs to borrow money but cannot rely on conventional sources, such as banks”.[4] This is particularly true among organizations and businesses run by Black, Indigenous, and people of color (BIPOC), for whom the impacts of discriminatory redlining practices persist today.

A key strength of The Endowment’s PRI structure is how it has partnered with Capital Impact Partners. The partnership and creation of the Healthier California Fund (HCF) allow Capital Impact to support more equitable access to capital for these organizations by focusing on health centers in underinvested communities and providing them with the support and resources necessary to complete a rigorous underwriting process. Through the HCF, Capital Impact is able to provide loans without many of the burdensome requirements that might otherwise hinder clinics from considering this type of financing. While loan terms vary by organization, PRI-backed loans generally trend toward longer repayment periods and lower interest rates when compared to conventional banking institutions. Capital Impact, like its peer CDFIs, also provides a more patient approach and more support than traditional financial institutions when detailed information is required. As one HCF investee noted, the loan process “did help us obtain additional funding… one funder simply asked us to return once underwriting was approved to request additional funding.” Clinics are using these investments to build new or expand on existing facilities and create space for much-needed services co-located within the primary care setting, including dental, mental health, and even spaces for fitness and meditation.

2. Supporting stability and robust service offerings

|

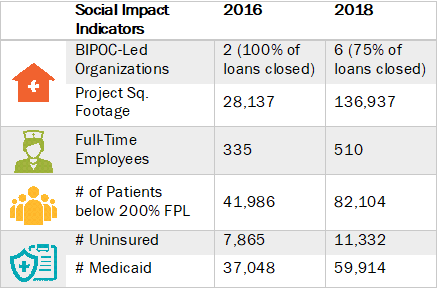

Capital Impact’s Social Impact Indicators, 2016 and 2018 |

|

The Endowment and Capital Impact Partners’ collective investment in community health centers is creating tangible results for patients. Investees emphasize “taking a whole-patient care approach, where patients, under one roof” can access a variety of critical services. By expanding access to much-needed services, the investments allow clinics to move beyond constant triage and referral to providing culturally responsive care in a more localized and sustainable way. Seventeen of the 19 clinics invested in through these PRIs serve a majority BIPOC patient population. Additionally, 10 clinics indicated that more than 20% of their patient population is uninsured, meaning they play an important role in providing care to California’s uninsured. In addition to providing comprehensive and culturally appropriate care to the community, health center expansions resulting from these PRIs are contributing to the creation of local, high-quality jobs. In the case of one HCF investee, they were able to increase staff from about 35 full-time employees (FTEs) to close to 50 FTEs for 2020. This local hiring means the clinic can provide enhanced and culturally appropriate care.

PRI in Action: The CPCA COVID Response Loan Fund

Though the Healthier California Fund has resulted in significant clinical shifts, the COVID-19 pandemic continues to strain community health centers and front-line health care workers serving California’s communities every day. Building on the lessons learned and deep partnership with Capital Impact Partners, The California Endowment and Capital Impact continue to work together as part of a collaborative response to COVID-19. The California Primary Care Association (CPCA) COVID Response Loan Fund was launched with partner organizations in October 2020 and is currently open to clinics seeking additional support as they respond to COVID-19.

Loans range from $250,000 to $1.5 million and are accompanied by a technical assistance grant. Eligible uses include working capital needs resulting from the COVID-19 pandemic. Funds can also be used to increase a health center’s testing and vaccination capacity.

Community health centers can apply now through April 30, 2021; to learn more about the key features of this fund and eligibility criteria, visit Capital Impact’s webpage. Loan decisions will be made in late May with loan funding planned for June.

The CPCA COVID Response Loan Fund is made possible through the generous support of several key partners.

- Alliance Healthcare Foundation

- The California Endowment

- California Primary Care Association

- The California Wellness Foundation

- JPMorgan Chase

- Richard W. Goldman Family Foundation

- UnitedHealthcare

Preliminary lessons from the Healthier California Fund’s program-related investments demonstrate the powerful economic and human impacts that equitable access to quality financing has to offer. Continued evaluation of PRIs is needed to determine how philanthropy can best utilize this investment tool to promote innovation and transformation within communities across California and the nation. To learn more about the Healthier California Fund PRI evaluation, check out the brief here.

[1] Henriques, R., et al. (2016). Program-related investments. The Center for High Impact Philanthropy, The University of Pennsylvania. Retrieved October 15, 2020.

[2] Foundation Source. (2019). Impact Investing and Private Foundations. Retrieved December 8, 2020.

[3] Per Internal Revenue Service (IRS) rules, foundation investments must meet three specific requirements to qualify as Program-related investments. For more information, visit the IRS website.

[4] Prasad, S., et al. (2020). Beyond the Grant: Foundations as Impact Investors. The Bridgespan Group. Retrieved November 21, 2020.